Home » Switzerland- Facts & figures

Government Type: Semi-direct democaracitc federal republic

Capital: Bern (also spelled Berne in English)

Currency: Swiss Franc (CHF)

Main Language: 4 national languages — French, German, Romansh, Italian

GDP Per Capita: 81,993.73 USD (2019)

Main Business sectors:

Employment Rate: 80.5%

Higher Education Rate: approx 44%

With internationally recognized research centers, strong technology know-how, and qualified and productive workforce, Switzerland is consistently ranked as one of the world’s most innovative countries. Switzerland is home to top research institutions and has unique R&D partnerships. They are also:

The main sources of employment law in Switzerland are the Code of Obligations, the Labour Act (and its regulations) and the terms agreed in the contract. Other legislation also applies with respect to:

Only self-employed persons are not subject to employment law.

Types of employment contracts:

Fixed-term (the contract ends on the date set at the outset)

Open-ended (the contract ends by notice of termination)

Collective employment agreements which are concluded between employers’ and employees’ associations.

Standard employment contracts are federal or cantonal enactments.

Unlawful dismissal may apply if a termination notice was given purely based on the grounds of age, race, disability, gender, sexual orientation, religion, medical. There is no tolerance towards discrimination.

While Switzerland is well aware of the global diversity and inclusion discussion, its employment law does not require that a diversity programme be established in the workplace except for in the public sector. However, a variety of Swiss companies across all industry sectors have since adopted group-wide diversity and inclusion initiatives and policy programmes.

Dismissals must not be abusive (wrongful or unlawful dismissal). If found to be abusive, the party may be required to pay a six-month indemnity.

Employees who are at least 50 years old and have worked for the company for at least 20 years receive severance compensation in the amount of a minimum of two and a maximum of eight monthly paychecks. If there is no contractual severance payment, the court will award an amount equal to two to eight months’ wages.

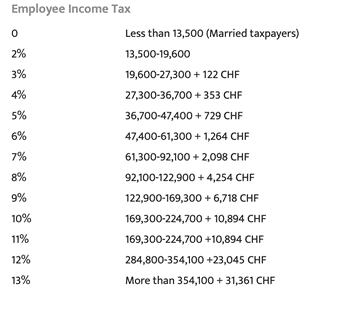

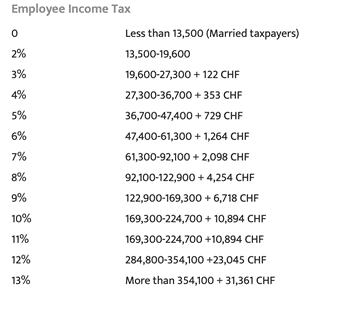

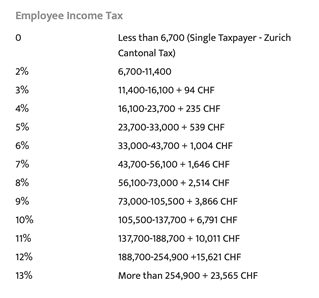

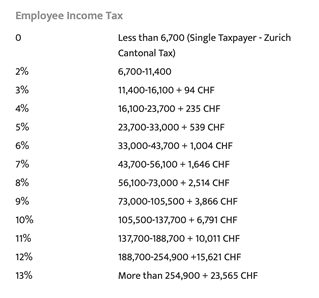

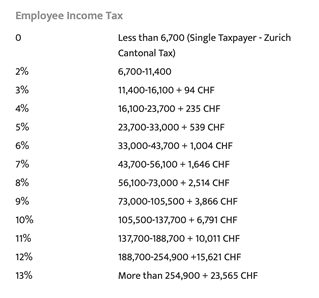

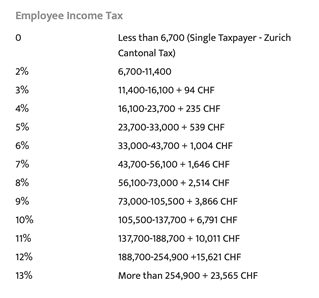

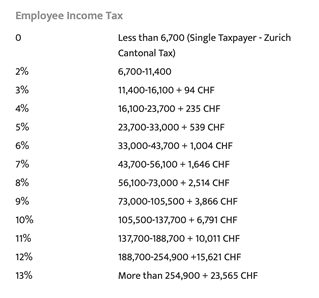

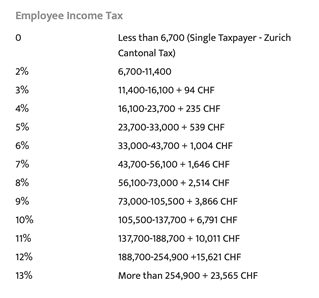

Income tax in Switzerland is levied by both the federal government and the employee’s canton. This means that the tax calculation in Switzerland is a combination of the rate set by the government and the rate in the employee’s local area.

The minimum paid annual holiday entitlement in Switzerland for all employees is four weeks. Young employees up to the age of 20 are entitled to five weeks of holidays per year. Vacation must be used and cannot be compensated by payment; compensation of vacation by payment is admissible only at the end of an employment relationship. For the duration of their holidays, employees are entitled to the same pay as if they were working. Part-time employees and employees paid on an hourly basis are entitled to pro-rata holiday time.

There is an obligation to pay employees who are unable to work due to illness for up to three weeks in the first year of employment and for longer periods at full pay proportionate to longer periods of employment. Cantons specify sick leave limits after an employee’s first year. Employers may require a medical certificate for any absence longer than three consecutive days due to sickness.

Maternity leave lasts 98 days where mothers are paid 80% of their wages in the form of a daily allowance up to the maximum of CHF 196/day.Women who return to work earlier lose their entitlement to compensation and must not work during the first eight weeks after the birth.

Working fathers are entitled to two weeks of paternity leave. The leave must be taken within six months of the child’s birth, either all at once, or spread out over individual days.The amount of compensation is the same as under the maternity insurance.

The Swiss pension system rests on three pillars: the Federal Old-age, Survivors’ and Invalidity Insurance (1st pillar), the occupational pension scheme (2nd pillar) and private pension schemes (3rd pillar).

The first pillar provides old age pensions as well as benefits for widowers and orphans. The ordinary age of retirement is 65 years for men, 64 for women. It can be anticipated or postponed, with financial consequences. It is an PAYGO system, financed by contributions from employees and employers (4.2% of the employee’s income each) and shall cover the basic living expenses.

The occupational pension scheme (2nd pillar) shall, together with the Old-age, Survivors’ and Invalidity Insurance, enable the insured person to maintain his or her previous lifestyle in an appropriate manner. It is a funded pension plan. It is compulsory for employees and is financed by both employees and employers. The sum of the contributions of the employer should be at least equal to the sum of the contributions of his employees. The second pillar offers old age pensions. The pension funds also provide benefits in case of invalidity and benefits to survivors in case of premature death. Under certain conditions, the second pillar can be used before retirement to buy a principal home or to start an independent activity.

The third pillar consists of private pension schemes provided by the private sector. It is optional and financed entirely by the individual.

Paid Care Leave (new legislation as per 1 January 2021) the new so-called care leave legislation introduces an obligation on the employer to continue to pay the salary for the care of a family member or partner with a health impairment, during a short-term absence of a maximum of three days per specific impairment, up to a maximum of ten days per year.

Care Leave for the Care of Seriously Ill Children (new legislation as per 1 July 2021): newly introduced is a childcare leave if an employee’s child is seriously impaired in health due to illness or accident. The leave is limited to a maximum of 14 weeks. Salary continuation is governed by the Swiss Federal Act on Income Compensation for Service Providers and for Maternity, which amounts to 80% of the salary and is capped at CHF 196 per day.

The mandatory Accident Insurance (UVG) contributes to the costs of medical treatment and gives financial support after accidents and occupational diseases. All employees occupied in Switzerland are covered. Employees who work for a minimum of eight hours per week are insured not only against occupational accidents and occupational diseases, but also against non- occupational accidents.

Sickness allowance insurance compensates for loss of salary due to incapacity for work caused by illness or pregnancy. Employers are obliged to continue paying salary to the employee in question for a certain amount of time.

The daily allowance benefits insurance relieves the employer from the beginning of the statutory salary payment. The duration of the statutory salary payment depends on the employee’s years of service. Adherence to a daily sickness allowance insurance is, however, not mandatory.

All employees in Switzerland who have not yet reached the legal retirement age must be covered by unemployment insurance, subject to certain conditions.

To be eligible for unemployment benefits, the employee must meet the following conditions:

If you become involuntarily unemployed, you are entitled to 70% of the average earnings paid into your unemployment insurance in the previous six months. If you have a child or your daily allowance falls below a predetermined minimum, you are entitled to 80% of the average earnings in the last six months.

The unemployment benefit is allocated as a daily allowance covering five days per week. Entitlement begins after a waiting period of five days of proven unemployment. Unemployment benefits provide up to 400 daily allowances to be received in a two- year period. Employees over 55 and having made unemployment insurance contributions for at least 18 months are permitted up to 520 daily allowances in the same period.

Let’s Socialize

Subscribe to our newsletter and stay updated to our offers and deals!

We are committed to protecting your privacy

Share:

* Subject to availability and terms and conditions of the promotion

<!– Calendly inline widget begin –>

<div class=”calendly-inline-widget” data-url=”https://calendly.com/global-ppl/from-web-site” style=”min-width:320px;height:630px;”></div>

<script type=”text/javascript” src=”https://assets.calendly.com/assets/external/widget.js”></script>

<!– Calendly inline widget end –>