Explaining the retirement schemes in Switzerland

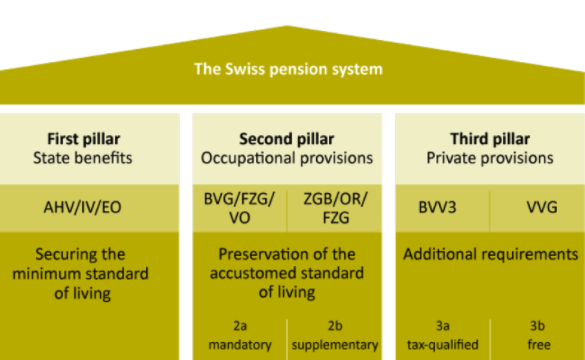

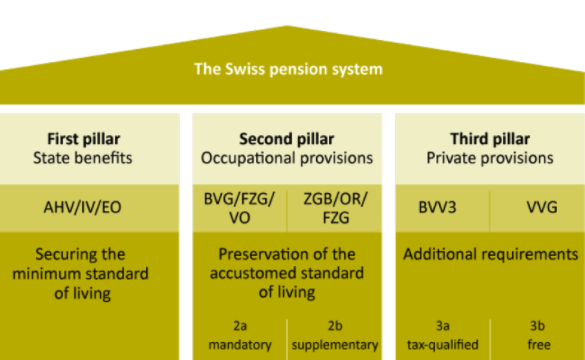

The Swiss pension system is based on the three-pillar pension model. It guarantees stability and social security at a collective level. Individually it enables people in Switzerland to enjoy their old age with financial confidence and self-determination.

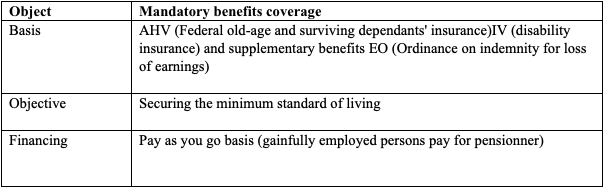

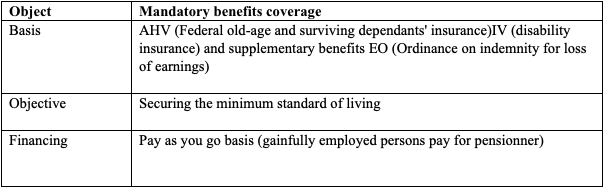

The mandatory 1st pillar is covered by the Old Age and Survivors Insurance and the Disability Insurance, or OASI and DI. The benefits are paid as pensions, covering the basic subsistence needs.

Financing for the first pillar is based on the principle of solidarity: those in employment (including cross-border commuters) and employers pay monthly contributions, which finance the pensions of those who are currently retired. At present, AHV age is 64 for women and 65 for men. The AHV pension must be applied for. The expected amount of one’s pension can be determined with an application for calculation of anticipated pension by the cantonal social security administration office.

With the first pillar, Switzerland meets its main obligation under the welfare state. Recipients of first pillar benefits thus have a minimum standard of living in old age, in case of disability and following a death. No more and no less.

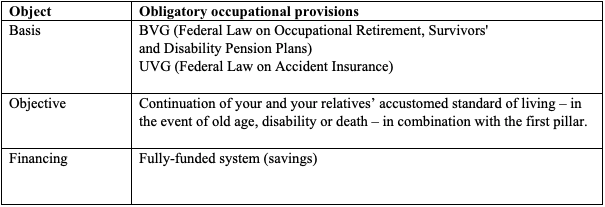

The mandatory 2nd pillar is formed by the pension fund. The basis for this is the Federal Act on Occupational Old Age, Survivors’ and Disability Pension Provision and Compulsory Accident Insurance, OASI/II and CAI, (BVG and UVG). The contributions from the pension fund are intended to maintain the standard of living.

Occupational pension funds, whose benefits, together with the AHV from the first pillar, are intended to cover up to 75% of the last salary. Occupational pensions are a fully funded system, which means individuals save and pay directly for their own benefits. The pension certificate, sent by the pension fund at the beginning of each year, provides information on one’s retirement pension. The amount mentioned therein is to be understood as “provisional,” since it depends on such factors as future salary increases, level of employment, conversion rate etc.

The second pillar is a further mainstay of the Swiss three-pillar system and contributes significantly to financial confidence and self-determination in old age.

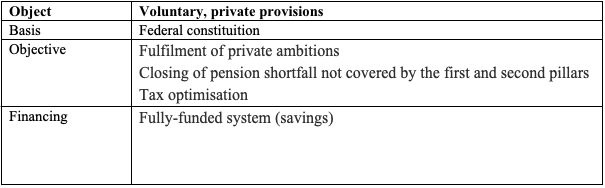

In the case of voluntary private pension plans, a distinction is made between the restricted pillar 3a and the unrestricted pillar 3b. They fill any existing pension gaps and cover additional, individual requirements.

Private pension provision was enshrined in the Federal Constitution as the third pillar in 1972. It serves to close gaps in coverage and to accumulate assets. A distinction is made between pillar 3a (tax-qualified provisions) and pillar 3b (non-tax-qualified provisions). Pillar 3a is capped at an annual maximum and subject to certain restrictions. On the other hand, you can deduct it from your annual taxes. Pillar 3b is subject to fewer restrictions but has no direct tax benefits.

Why are private provisions so important? The first pillar (AHV) and the second pillar (pension fund) cover “only” about 60 to 75% of the last salary. Depending on your income, it may even be less than that.

The third pillar, which is supported by the Federation and cantons through tax breaks, is intended to supplement one’s income after retirement.

Global People is a leading local employment solutions provider for national and international corporations and can advise and escort you in your next destination.