Starting A Business In The Netherlands

Doing business internationally expands a company’s horizon and offers unique opportunities for growth, development and profit building.

The Netherlands is one of the most open economies in the world and among the best countries for technology and innovation. It offers an outstanding infrastructure – including Europe’s largest port –, a competitive business climate and a strong treaty network.

The Dutch tax system features several tax incentives to stimulate innovation and business activities. And as an internationally oriented country, the Netherlands is home to many highly educated foreign workers.

However, there are several administrative issues expats need to take care of.

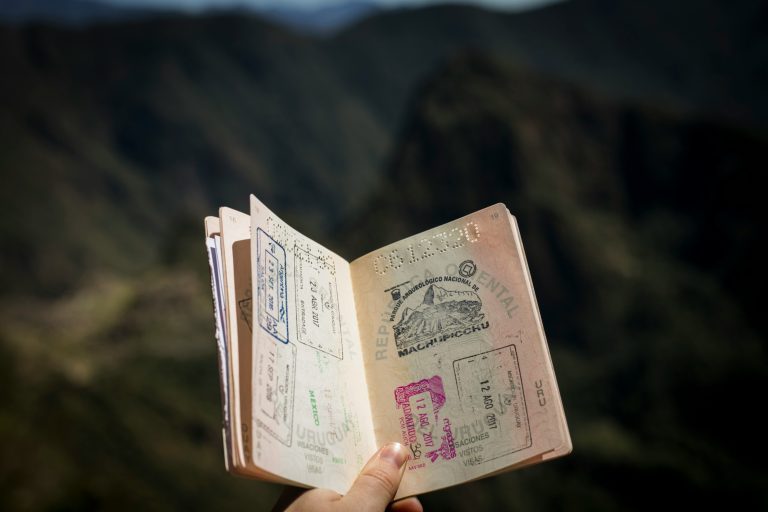

To be able to start up a business here, you must first make sure that you can stay in the Netherlands. EU, EEA and Swiss nationals are permitted to live and work in the Netherlands under EU law. If you don’t come from an EU or EEA country, or you’re not Swiss, then you will need to apply for a provisional residence permit (MVV) and in some cases a work permit (TWV).

The company needs to decide which legal form their business will take. It’s important to choose a structure with the right fit, as this determines the liability for your business debts and tax obligations.

These and other related matters can be complicated but there are professional services that can help you out with the formation of your company.

When you have decided the type of business you would like to start, then you need to register it with the KvK (Kamer van Koophandel), the Dutch Chamber of Commerce, which will enter it in the Dutch Trade Register. Registration should happen from one week before you start doing business to one week after.

To register your business you will need to be registered with your local municipality, otherwise you must provide authenticated proof of your residential address abroad.

You will need to select a business name (it’s possible to register more than one) and prepare a description of your business activities. It’s possible to check existing business names on the KvK search page (in Dutch).

Registering your business

- Have your papers in order for entering the Netherlands.

- Choose a trade name for your Dutch business.

- Choose a Dutch legal structure.

- Check whether your business must register UBOs.

- Fill out the online form.

- Make an appointment with KVK.

- Costs and KVK number.

- Bring your Dutch business premise lease contract.

New businesses also need to be registered with the Belastingdienst (Dutch tax office). It is wise to register as soon as possible, so that you can claim VAT deductions on the investments you make to start the business.

Tax types for businesses

If you have a business in the Netherlands then you will need to pay some or all of the following types of tax:

If you have a business then you will need to do your annual income tax return, which is similar to when you are working in the Netherlands. Completing your income tax when you have a business is a little complicated as you need to prove you are an entrepreneur to gain access to certain tax benefits. A good accountant is essential for helping you to calculate your income tax.

Employers need to deduct payroll tax from their salaries. Payroll tax includes wage tax and national insurance and pension contributions.

If you have an incorporated business, such as a BV or NV, then you need to calculate and pay corporation tax (vennootschapsbelasting). Foundations and associations also sometimes need to do a corporate tax declaration.

There are several tax benefits, collectively known as the ondernemersaftrek (entrepreneurs’ deduction), that are available for new businesses in their first years.

Investment tax credit 2021 (BIK)

The Baangerelateerde Investeringskorting (BIK) was introduced on January 1, 2021. This investment tax credit scheme applies to investments in 2021 or 2022. The investment decision must be taken after October 1, 2020, full payment must be made in 2021 or 2022 and the new business asset must be in use within 6 months of making the decision.

In the Netherlands, businesses are obliged to keep administrative records for seven years. This includes both electronic and paper records such as:

- Invoices sent

- Invoices received

- Bank statements

- Contracts and agreements

- Business activity expenses

- How to format your invoices

Vacation time

- Maternity / parental leave

- Pension

There are many administrative concerns when it comes to starting a business in a new country. It is always advised to have experts on hand that can help handle all issues regarding compliance, legal and human resources. As such, Global People assures you that we will be with you every step of the way.

Global People is a leading local employment solutions provider for national and international corporations and can advise and escort you in your next destination.