Hiring Remotely in Italy

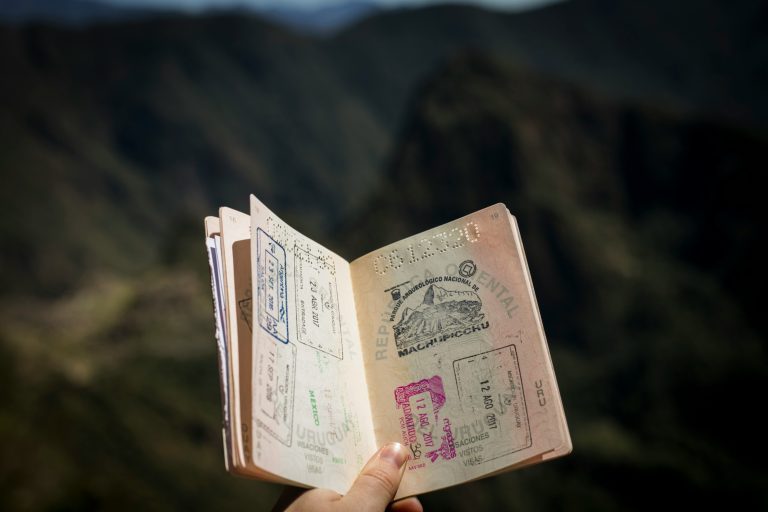

The pandemic has limited the number of workers who go to the office every day and remote working has become the new norm. There is an increase in the competition for jobs as remote work attracts digital nomads.

Globally, there have been changes to taxes and regulations in support for this phenomenon. Greece offers tax relief at 50 per cent. Spain, Dubai and Estonia offer ad hoc visas and Italy also has incentives to attract digital nomads.

The digital nomad population has expanded from freelance creatives and entrepreneurs to include marketing and communication professionals, graphic designers, public speaking coaches, life coaches, computer scientists and programmers.

Working online is a norm now and Italy wants to attract these workers and their incomes. It is becoming increasingly popular to hire remote workers as employees or as contractors.

What are some ways companies can go about hiring remote workers?

Many contractors consider themselves self-employed freelancers, drafting their own contracts and invoices, setting project milestones with the client, and arranging a payment method.

Another business structure used in Italy by contractors is a limited company. This can be done by either Italians or expats who have immigration permissions in place. Global People can help you with this aspect. Your company would contract directly with the limited company as you would any business, and the limited company essentially leases out the contractor to fulfil project terms. The limited company handles all of its own business compliance in Italy, and you only have to work out suitable payment arrangements.

Newer contractors may look to minimize the risk of cross-border contracting and may use an umbrella company as a third party to the contract. As an intermediary, the umbrella company facilitates both payment and performance.

The umbrella company will confirm completion of projects, invoice your company and then issue payment to the contractor, with all taxes withheld. This eliminates the risk of cross-border contracting for both parties.

As contractors in Italy are responsible for their own income taxes and social contribution, your company has no obvious tax obligations. However, if you hire freelancers and they are generating revenue for you (such as finalizing frequent sales contracts), you might trigger permanent establishment (PE).

Corporate taxation of local revenues is a result of PE, and is something to be aware of when you hire foreign workers in their own country. PE is unlikely for common remote roles that may not have a direct effect on revenue, such as IT support, customer service, and marketing.

Paying 13th and 14th-month salaries

This requirement does not extend to independent contractors who are not covered by labour and employment benefits.

But, if you were to hire a long-term contractor who performs well, a holiday bonus is one way to show appreciation. The downside to doing so is that it starts to colour the working relationship as ‘disguised employment’ which can result in misclassification and compliance risk.

Misclassification is the key compliance risk when hiring remote workers in Italy. Generally, a worker is a contractor if they control their own work schedule, methods and delivery. Any control or supervision by the company, and fixed monthly payments, starts to look like formal employment.

Italy is pro-labour rights and disfavors any incidents of misclassification that might interfere with statutory entitlements.

As the client of a contractor, you avoid paying 20-30% for employer social contributions. Yet self-employed workers are still entitled to many government benefits such as maternity leave. If a contractor were to claim that they are actually an employee, the company would have to prove that they are bot.

If the worker is reclassified, payment of past-due social contributions, fines, and damage will be relegated back toyhr company. In order to retain the worker, you would also have to set up a formal employment relationship with a local payroll.

As a foreign company you might not be compelled to pay, but could be barred from future business activity in the country.

How Global People can help you hire remote workers in Italy

Global People acts as a PEO and as an employer of record for local talents and experts in leading local markets while providing all HR services, such as administering payroll and benefit plans. As a company looking to hire remote workers in Italy, we can assist with the relationship to the new hire.

Global People is a leading local employment solutions provider for national and international corporations and can advise and escort you in your next destination.